Politicians whisper “maybe,” the markets jump, and the cannabis community cheers for a win that never comes. The Great Cannabis Con Job exposes the bait-and-switch of rescheduling talk, revealing how it stalls real reform, distracts from federal prohibition, and leaves prisoners behind. This is not progress; it is political theater dressed as change

DEA Stalls on Cannabis Rescheduling: What’s the Hold-Up?

The DEA is dragging its feet on cannabis rescheduling despite over 43,000 public comments and a formal Schedule III recommendation from HHS. What’s the hold-up? This deep-dive exposes the legal limbo, political stall tactics, and why America’s weed policy is still frozen in time.

Tommy Chong Returns to Raise Hell at Hash Bash

The Ann Arbor Hash Bash, held annually since 1972, symbolizes the ongoing fight for cannabis rights and culture. Headlined by Tommy Chong in 2025, it embodies protest and celebration against restrictive drug laws. The event attracts diverse generations, emphasizing the fight for freedom and autonomy amid the commercialization of cannabis culture.

Paradise in the Crossfire

The Hawaii Cannabis Expo showcased the ongoing battle for cannabis reform, featuring advocates like cancer survivor Hansel Aquino, who share transformative experiences with cannabis. Despite resistance from law enforcement and bureaucratic hurdles, public support is growing. The movement seeks to dismantle stigma and outdated laws while addressing the thriving black market.

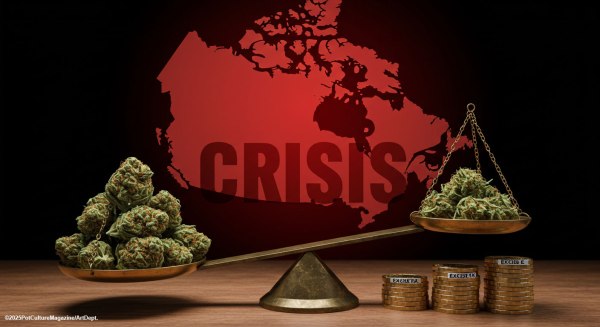

Beyond Trudeau: Can Canada’s Cannabis Market Survive?

Justin Trudeau's resignation leaves Canada's cannabis industry in a vulnerable state, raising concerns about future regulatory support and sustainability. While legalization has brought progress, existing financial burdens and restrictive policies hinder growth. Industry stakeholders must unite to advocate for reforms that ensure the sector's viability and maintain Canada's leadership in cannabis regulation.

Canada’s Cannabis Tax Crisis

The Canadian cannabis industry is in crisis due to high federal excise taxes and provincial markups, which make legal products expensive and fuel the illicit market. A significant percentage of producers report negative net income, and reforms are urgently needed to adjust tax rates and eliminate markups to support legal businesses effectively.