—Cannabis Tax—

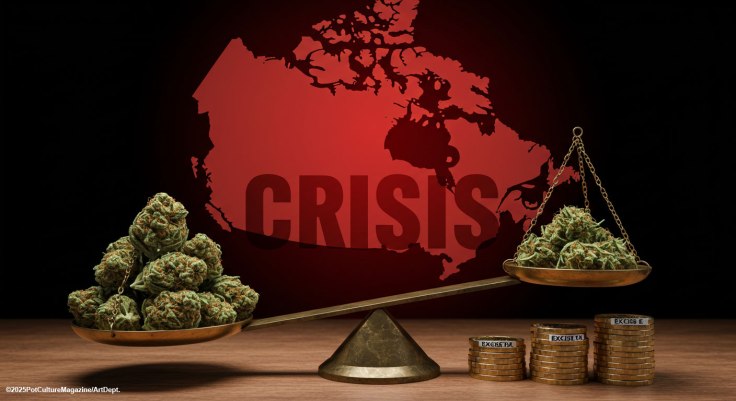

The Canadian cannabis industry is facing a financial crisis, and at the heart of the issue are federal excise taxes and provincial markups. These combined costs are choking producers, impacting retail prices, and inadvertently giving the illicit market a competitive edge.

Canada’s federal excise tax on cannabis is straightforward but deeply flawed: producers must pay the greater of $1 per gram or 10% of the product’s sale price. Comparatively, U.S. cannabis excise taxes vary by state but often scale with the market price, while Canada’s flat-rate system becomes more burdensome as prices drop. This system, implemented in 2018, was meant to regulate the legal market and generate revenue for public health and safety initiatives. However, as market prices for cannabis have dropped, the excise tax has become disproportionately high, consuming up to 30-50% of a producer’s revenue in some cases.

In addition, provincial governments impose their own markups. These vary widely, but some provinces, such as Alberta, add up to 68.8% in wholesale markups, further squeezing producers’ margins and making legal cannabis products significantly more expensive than their illicit counterparts.

The combined effect is that in 2022, a survey by the Cannabis Council of Canada revealed that 83% of licensed producers reported negative net income, with unpaid excise tax bills exceeding CA$200 million by mid-2023. High wholesale prices make it difficult for retailers to compete with illicit sellers who aren’t subject to taxes or regulations. This disparity fuels the ongoing strength of the black market, undermining the goals of legalization. Consumers ultimately bear the burden, with these taxes and markups driving up the price of legal cannabis products, making them less accessible and affordable.

The Canadian government views the excise tax as essential for funding public health initiatives, education campaigns, and law enforcement efforts related to cannabis regulation. It argues that the tax revenue supports programs to reduce harm and promote responsible use. However, critics claim that these benefits outweigh the financial burden on legal producers and the resulting boost to the illicit market.

Producers and advocates are calling for a fairer tax system. Key demands include adjusting the excise tax to reflect the product’s market value, eliminating provincial markups to create a more level playing field across Canada, and streamlining tax administration by transitioning to a single national excise duty stamp to reduce costs and bureaucracy. In December 2024, the Canadian government announced plans to review the cannabis excise tax system in 2025, with a focus on simplifying the process. While this is a step in the right direction, industry leaders emphasize that meaningful reform must address the tax rates themselves.

For those who want to support the cannabis industry or push for reforms, consider these steps: read the Cannabis Council of Canada’s report on the impact of excise taxes, join campaigns calling for tax reforms, such as those hosted by the Cannabis Amnesty organization, and contact your local MP to share concerns about how the current tax structure affects legal businesses. Advocacy groups like MCC (Medical Cannabis Canada) are also actively working to bring attention to this issue and provide resources for public involvement.

Canada’s cannabis industry was supposed to be a beacon of regulated, safe, and fair production and consumption. However, without significant changes to the tax system, this vision remains under threat. Now is the time for consumers, producers, and advocates to push for reform and support the legal market.

© 2025 Pot Culture Magazine. All rights reserved. This content is the exclusive property of Pot Culture Magazine and may not be reproduced, distributed, or transmitted in any form or by any means without prior written permission from the publisher, except for brief quotations in critical reviews.

Discover more from POT CULTURE MAGAZINE

Subscribe to get the latest posts sent to your email.

Leave a comment